Table of Content

There are many types of fixed-rate mortgages, such as 15-year fixed-rate, jumbo fixed-rate and 30-year fixed-rate mortgages. Lenders are currently offering rates that start as low as 5% to 6% for borrowers with good credit, but rates can vary depending on your personal financial situation. Talk to us about low down payments and jumbo mortgage rates for homes over $1 million dollars. Jumbo loans require a higher minimumcredit scorethan conventional loans.

In 2018 homeowners are able to deduct from their income interest expenses on up to $750,000 of mortgage debt. At a 5% interest rate, a homeowner would pay at least $37,249 in interest during the first 12 months on a mortgage debt above this cap. Today’s 30-year-fixed rate mortgage—the most popular mortgage product—is 6.66%, down 0.15% from a week earlier. Over the past 52 weeks, the lowest rate was 6.57% and the highest was 7.41%. Programs, rates, terms and conditions are subject to change without notice.

What is a jumbo reverse mortgage?

Not all financial institutions offer jumbo loans, but Greater Nevada Mortgage does. Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible. Typically, jumbo loans have more qualification requirements than conventional conforming loans as they are larger and considered a higher credit risk.

Depending on loan guidelines, mortgage insurance may be required. If mortgage insurance is required, the mortgage insurance premium could increase the APR and the monthly mortgage payment. Your loan’s interest rate will depend upon the specific characteristics of your loan transaction and your credit history up to the time of closing. The estimated total closing costs in these rate scenarios are not a substitute for a Loan Estimate, which includes an estimate of closing costs, which you will receive once you apply for a loan. Actual fees, costs and monthly payment on your specific loan transaction may vary, and may include city, county or other additional fees and costs.

Second Mortgage Option

The minimum credit score for jumbo loans is usually around 680, though some lenders will accept 660, whereas a typical minimum credit score for a conforming 30-year loan is usually 620. As of 2023 the FHFA set the conforming loan limit for single unit homes across the continental United States to $726,200, with a ceiling of 150% that amount in areas where median home values are higher. The limit is as follows for 2, 3, and 4-unit homes $929,850, $1,123,900, and $1,396,800. The following table shows current 30-year jumbo mortgage rates available in Los Angeles.

Lenders often require a 20 percent down payment for jumbo loans, compared with as little as 5 percent — or sometimes less — for a conforming mortgage. When a loan exceeds the standard, conforming amount backed by the Federal Housing Finance Agency (currently $647,200), a jumbo loan is appropriate. Due to the size of a jumbo loan, borrowers must have higher credit scores and low debt-to-income ratios.

Today’s Mortgage Rates

Robert Heck, vice president of mortgage at Morty, an online mortgage broker. Your home can be jumbo size, but that doesn’t mean your interest rate has to be jumbo, too.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. The Fed last raised its federal funds rate in September, and is expected to do so again in November. In order to compare mortgage products, you must "Add Compare" at least one more product from this table or any other Mortgage table.

Lenders look at this number to determine whether you can afford your mortgage payments. Lenders want borrowers to have a DTI of no more than 43%, but ideally seek DTI ratios of 36% or less. Conventional, fixed-rate mortgages usually have different rates between loan terms; longer terms hold higher interest rates than shorter terms. For instance, a 15-year mortgage usually has lower rates than a 30-year term. For today, Thursday, December 22, 2022, the national average 30-year fixed jumbo mortgage APR is 6.47%, increased to compared to last week’s of 6.62%.

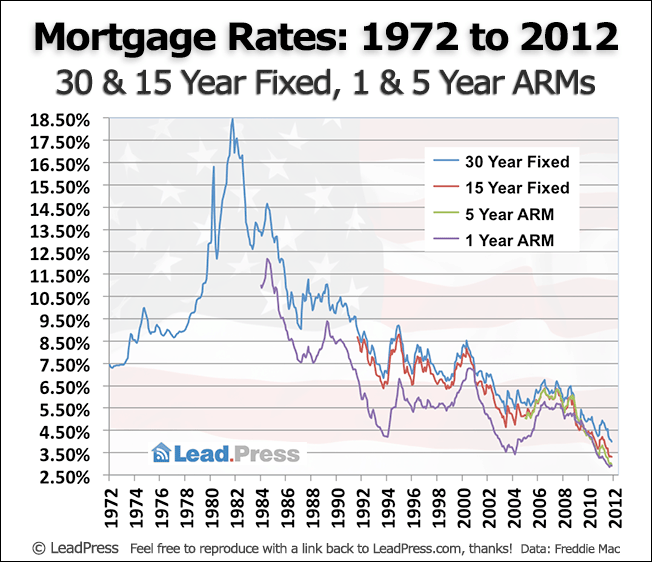

Since the early 1980s interest rates have been in a secular downturn & global debt levels have exploded. Asset price trends may change if rising interest rates cause debt to grow at a slower rate. In 2017 homeowners are able to deduct from their income interest expenses on up to $1 million of mortgage debt. At a 4.25% interest rate, a homeowner would pay $42,174.13 in interest during the first 12 months on $1 million in mortgage debt. That compares against the following standard deduction amounts.

As with any mortgage, it’s a good idea to comparison shop for jumbo loan rates. Credible makes it easy to compare mortgage rates from multiple lenders. If you’re eligible for a USDA or VA loan, you won’t need to put any money down. Conventional loans are often ultimately bought by Fannie Mae or Freddie Mac, the big government-sponsored enterprises that play an important role in the mortgage lending market. They are offered by virtually every type of mortgage lender, with some programs allowing for a down payment as low as 3 percent.

A good rule of thumb is using the front-end DTI to determine your maximum affordability, which shouldn't exceed 28% of your income. APRs tend to be higher than their corresponding interest rates. When they are similar, it means the mortgage has fewer added costs rolled into the loan.

Three sisters who inherited a house worth about $2.5 million seek to buy out one sister for 1/3 of the value and to finance it through reverse mortgage. Just like forward loans, there are both fixed rate and adjustable-rate reverse mortgage loans available. The fixed rate loans are fixed for life and the adjustable-rate loans will adjust their rates in accordance with the terms of the loan. Whether or not you should get a jumbo loan depends on the home you want to buy and if you can meet a lender’s eligibility criteria.

While these minimums can help you get into a home sooner, the higher your down payment, the lower your mortgage rate and the less you’ll need to pay in mortgage insurance premiums. If you can put 20 percent down, you won’t pay any mortgage insurance at all, and likely get the most favorable rates. Our advertisers do not compensate us for favorable reviews or recommendations.

Home Equity Loan Rates for December 2022

In order to assess the best jumbo mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nation’s top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

For one-unit properties, the 2022 conforming limit starts at $647,200, but it can be as high as $970,800 in certain high-cost areas. Buyers who are trying to purchase a home that’s priced above the limits in their county will need to look into a jumbo mortgage loan. It’s also possible to tap your home equity to pay for home renovation, or, if you want to pay down your mortgage more quickly, you can shorten your term to 20, 15 or even 10 years. Because home values have risen sharply in the last few years, it’s also possible that a refinance could free you from paying for private mortgage insurance. Average home equity loan rates are currently 7.8%, which is higher than the average rate for a 30-year fixed mortgage at 6.78%.

No comments:

Post a Comment